The world is in metacrisis. That means that many crises are occurring simultaneously and affecting one another.

This calls for rethinking the nature of problem-solving. Root causes should be identified rather than merely treating their symptoms. Traditionally, problems have been tackled in isolation. That approach has led to the metacrisis.

Although the exact origin of the term metacrisis is unclear, thinkers like Daniel Schmachtenberger, Jonathan Rowson, and Michael Every have discussed it extensively and brought it into wider attention.

The word crisis comes from the ancient Greek krisis meaning a turning point in a disease that leads either to recovery or death. The Greek prefix meta- means over or across. Metacrisis, therefore, means an ensemble of life-or-death situations that overlap and influence each other.

Figure 1 illustrates the overwhelming complexity of the world’s metacrisis. It is a web of systemic, interconnected, compounding processes. Broad categories including energy, environment, population growth and financial overshoot.

Figure 1. The Metacrisis is a web of complex, systemic, interconnected, compounding processes.

Source: Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

All of the processes are interconnected, and changes to one inevitably affect the others. Changing things without thinking about its cascading effects can lead to disastrous outcomes yet piecemeal changes have been the norm so far in society’s approach to problem-solving.

We want solutions but do we understand the problems we are trying to solve?

“How can we begin to fathom the future if we don’t understand the present? And that’s the point. We need to understand how the world works right now. And that means understanding the basics. And I just don’t think we understand the basics before we even get to the complex stuff.”

Edmund Conway

Attention must be placed first on the whole, not on the parts. That includes the natural world. It is the source of the resources including food that support human survival and prosperity. Disregarding the effects of our actions on nature is among the principal reasons for the metacrisis.

Climate change activism is a prime example of focusing on parts rather than the whole. Figure 2 shows an activist fixated on carbon emissions, which is just one aspect of climate change. Surrounding the circle are other issues like biodiversity loss, air pollution, and overconsumption.

Climate change is only a part of the larger environmental and ecological crisis. Focusing mainly or solely on carbon emissions overlooks the broader context which includes energy, the economy, society, and human behavior shown in Figure 1.

A holistic approach is needed that moves from the whole to the parts and back again. Otherwise, we are merely shifting problems from one area to another and probably making everything worse.

Figure 2. Climate change is a narrow view that looks only at one part of the whole.

Source: Jan Konietzko @FUTUREEARTH & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

Even in the narrow case that only considers emissions, there is no evidence that the renewable energy transition has changed their upward trajectory despite thirty-six international climate conferences and trillions of dollars of investment over the last forty years. Global CO₂ emissions have increased +18 gigatons (+93%) since the first World Climate Conference in 1979 and +15 gigatons (+61%) since COP 1 in 1995 (Figure 3).

Figure 3. Global CO₂ emissions have increased +18 gigatons (+93%) since the first World Climate Conference in 1979 and +15 gigatons (+61%) since COP 1 in 1995. Source: Our World In Data, Stanford University & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

In fact, there is no evidence that an energy transition exists. Energy consumption and population continue to increase every year.

Historical data on world energy consumption from 1800 reveals an additive rather than a subtractive pattern (Figure 4). This means that new energy sources are layered on top of old ones, rather than replacing them.

Today, both biomass and coal consumption exceed their 1800 levels, with renewable energy sources like wind and solar barely making a statistical impact. This underlines that, despite the estimated investment of about $10 trillion in renewables over the last twenty years, they are just a small addition to our ongoing conventional energy usage.

Figure 4. The world’s population increased from less than one billion people in 1800 to more than eight billion today. The increase in energy supply from coal, oil and natural gas made that possible.

Source: EIA, BP, IEA, FRED, OWID, World Bank & Labyrinth Consulting Services, Inc. Click on the image to enlarge.

|

The popular idea that fossil fuels can be, and are being, replaced by renewable energy is false. There is no energy transition or green revolution. Wind and solar accounted for 2.4% of world energy consumption in 2022 – a zero-rounding error. There has never been replacement of one energy source by another. No energy source has ever been substantially reduced.

Population was 2.5 billion when I was born in 1950. It has more than tripled in my lifetime to more than 8 billion in 2023. Total energy consumption has increased more than 60-fold in that same period. Half of all historical oil consumption has been since 2000.

Growth is the problem. Carbon emissions are a consequence of the growth in energy consumption that has enabled the growth in human population and economic activity.

A barrel of crude oil contains the energy equivalent of about four-and-a-half years of human work (Figure 5). In 2023, the world used 84 billion barrels of oil equivalent from coal, natural gas and oil. At four-and-a-half years of work per barrel, that means that society has 378 billion fossil energy slaves working for us all the time.

The work value of a barrel of oil is approximately $337,000 using the 2022 U.S. median income of $75,000. That explains the high levels of productivity that have improved global living standards over the last century. Half of all historical oil consumption has been since 2000. No other energy source can remotely compete. It is delusional to imagine that humans will voluntarily trade fossil fuel prosperity for a much poorer renewable energy world.

Figure 5. 4.5 years of work per barrel of oil = 378 billion fossil slaves.

Source: Institute for Energy & Our Future & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

The current world strategy to reduce carbon emissions is to substitute renewable for fossil fuel sources of energy. That approach is not having much effect in terms of absolute volumes of energy supplied or consumed.

Figure 6 shows that there has been average annual addition of 11 billion worker equivalents of energy consumption since 2020. This is included in a total level of that has increased from 163 billion worker equivalents in 1975 to 363 billion worker equivalents in 2023.

I am describing reality. I am not suggesting that using fossil fuels is good nor do I minimize the risks of climate change and global heating.

Figure 6. Annual addition of 11 billion worker equivalents of energy consumption since 2020.

Level has increased from 163 billion worker equivalents in 1975 to 378 billion in 2023.

Source: Our World in Data & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

As long as energy use continues to increase, efforts to limit carbon emissions will be negligible, and temperature will rise.

Figure 7 shows that global mean temperatures are at the highest level in 24,000 years. Global heating is real. It is a problem. It is because of growth. Carbon emissions are a consequence—not the cause—of temperature increase. Ending fossil fuel use is simply not a practical idea in the medium term. Growth—not fossil fuels—is the root cause that must be understood.

Figure 7. Global heating is real. It is a problem. And it is because of growth.

Source Osman et al (2021) and Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

Growth is also the root cause of the ongoing crisis of the natural world. Populations of mammals, birds, amphibians, reptiles, and fish have declined by an average of 69% since 1970 (Figure 8). Expansion of the human enterprise through deforestation, urbanization, and pollution have led to the destruction and fragmentation of natural habitats, making it difficult for species to survive and thrive.

Figure 8. The average abundance of wild animal species has decreased -69% since 1970.

The shaded area represents the statistical uncertainty.

Source: Our World in Data, World Wildlife Federation & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

In the first part of this century, geopolitical conflicts centered mainly around terrorism and Middle Eastern conflicts. Since 2020, tensions have been broader and have more directly involved major powers. Strengthening of alliances between Russia, China, Iran, and the BRICS (Brazil, Russia, India, China, South Africa) have been particularly significant.

A fragmentation of the old world order is occurring. The United Kingdom’s exit from the European Union challenged the unity of the EU and led to renewed discussions on sovereignty and regionalism within Europe. The COVID-19 Pandemic exposed and exacerbated existing geopolitical tensions. Nations turned inward, prioritizing national interests over global cooperation.

Russia’s Invasion of Ukraine marked a significant shift in European security dynamics. This conflict has led to a reassertion of NATO’s relevance, increased defense spending in Europe, and a push for energy independence from Russia. It has also deepened the divide between Western nations and Russia, and renewed alliances between Russia, China and Iran.

The strategic competition between the US and China has intensified, affecting global trade, technology, and military affairs. The US has taken measures to limit China’s access to advanced technology, while China has expanded its influence through initiatives like the Belt and Road Initiative. The conflicts over Taiwan and the South China Sea continue to be flashpoints. Both countries have been engaged in a trade tariff war since 2018.

Populist and nationalist movements have gained traction in many countries, challenging traditional political establishments and international institutions. This trend has been evident in countries like the US, Brazil, India, and parts of Europe, where leaders have prioritized national sovereignty over multilateral cooperation.

The US and NATO’s withdrawal from Afghanistan after two decades marked the end of a significant chapter in international military intervention. The rapid takeover of Afghanistan by the Taliban has led to questions about the efficacy and future of international nation-building efforts and military interventions.

The Abraham Accords, which normalized relations between Israel and several Arab states, might have potentially reshaped Middle Eastern alliances. The recent Hamas attacks on Israel were likely aimed at undermining those new alliances. Meanwhile, ongoing conflicts in Syria and Yemen, along with the enduring tensions between Iran and Saudi Arabia, continue to destabilize the region.

Drone and missile attacks by Yemen’s Houthi militants on cargo ships in the Red Sea and the Bab el-Mandeb—the vital link between Europe and Asia through which 9% of world shipping passes daily—are causing chaos (Figure 9). Most ships now detour around South Africa’s Cape of Good Hope, driving up shipping costs. This surge complicates efforts by European and US central banks to control inflation. Fitch Ratings predicted in February that these Red Sea disruptions could boost prices of US imports by 3.5% by the end of 2024.

Ocean freight rates from the Far East to the U.S. are up 36%-41% month over month, while air freight has risen 9% this year. DHL reports that high ocean freight rates might persist until early 2025, potentially hitting $20,000-$30,000. Longer Red Sea transits, container shortages, and canceled Asian sailings are driving up spot rates. Notably, demand isn’t the sole factor; ocean freight orders are down 48% month over month.

About 20 million barrels oil pass through the Strait of Hormuz daily and more than 6 million barrels per day move through the Bab el-Mandeb.

Figure 9. Red Sea attacks increase shipping times and freight rates.

Source: EIA, Bloomberg and Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

The push for renewable energy and the transition away from fossil fuels is creating new geopolitical tensions. Countries rich in renewable resources or critical minerals for technology (e.g., lithium, cobalt) are gaining strategic importance, while traditional oil and gas exporters face new challenges.

The global financial system is increasingly fragile, primarily stemming from massive debt levels, geopolitical risks, increasing interconnectedness, and market volatility. High levels of public and private debt in many countries pose a risk to financial stability. Global debt averaged 220 percent of GDP in 2022 (Figure 10).

Figure 10. Global debt averaged 220 percent of GDP in 2022.

Source: IMF and Labyrinth Consulting Services.

Click on the image to enlarge.

|

The global financial system is highly interconnected, meaning a crisis in one region can quickly spread to others. Financial institutions and markets are increasingly reliant on digital infrastructure, making them vulnerable to cyber-attacks. Markets are increasingly driven by high-frequency trading and algorithmic trading, which can exacerbate market volatility. Flash crashes and significant market swings can occur with little warning, as seen in events like the 2010 Flash Crash and the 2020 market turmoil caused by the COVID-19 pandemic

Geopolitical tensions and trade wars, like those between the US and China, create uncertainty in global markets. Sanctions, political instability, and conflicts can disrupt financial markets and trade flows, affecting global economic stability. US tariffs on China are likely to increase inflation and consumer costs, aggravate supply chain issues, and further push the Global South further into China’s orbit.

The Russia-Ukraine conflict and subsequent sanctions on Russia have affected global energy prices and financial markets. Higher energy and commodity prices put strain on an already fragile European economic recovery from Covid economic closures. Europe’s energy prices are moderating as alternate sources of natural gas and oil were hastily substituted but the true cost of this transition is considerable.

The metacrisis has inevitably affected the global economy. Since 2020, the global economy is arguably weaker primarily because of higher energy costs, geopolitical conflicts, inflation, and the costs associated with the energy transition and climate change. Higher energy costs have raised operational expenses for industries worldwide, affecting everything from manufacturing to transportation. This has contributed to increased costs for goods and services, slowing economic growth.

Real world oil prices averaged only $42 per barrel from 1986 to 2003 but have averaged more than twice that for the last 20 years. Lower oil prices because of shale plays were an anomaly that ended after 2020 (Figure 11). A secular period of relative oil scarcity is underway, and is likely to get progressively more acute in coming decades unless the global economy weakens substantially affecting demand.

Figure 11. Real world oil prices averaged only $42 per barrel from 1986 to 2003

but have averaged more than twice that for the last 20 years.

Lower oil prices because of shale plays were an anomaly that ended after 2020.

Source: EIA, U.S. Dept. of Labor Statistics & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

Inflation rates have surged globally due to supply chain disruptions, increased demand post-COVID-19, and rising energy costs. Many economists ignore or dismiss effect of oil prices on inflation rates but the correlation is undeniable (Figure 12).

Figure 12. U.S. inflation and oil price fell in 2023 but federal funds rate increased. Inflation was lower in Q1 2024, oil price rose and federal funds rate was marginally higher.

Source: St. Louis Federal Reserve Bank, EIA & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

Central banks have had to hike interest rates to combat inflation, which in turn slows down economic growth and increases borrowing costs. Higher inflation erodes purchasing power, leading to reduced consumer spending, which is a key driver of economic growth.

The shift from fossil fuels to renewable energy sources involves substantial investment in new technologies and infrastructure. These costs can be significant for both governments and businesses, affecting economic stability in the short term. Increasingly frequent and severe climate-related disasters, such as hurricanes, floods, and wildfires, cause direct economic damage and disrupt global supply chains. The costs of rebuilding and mitigation efforts further strain economic resources.

Despite clear evidence that the world’s efforts to decarbonize are failing, there is a constant chorus of enthusiastic pronouncements about the superiority of renewables over fossil fuels. These offer only false hope and trivialize the serious, complex challenge of genuinely reducing carbon emissions.

Those who believe that a renewable energy transition is possible seem to ignore that carbon emissions, GDP, population and society’s ecological footprint all correlate with energy consumption (Figure 13). That means that there is a cost for lower emissions.

Unless the future is somehow completely different from the past and present, the only solution to climate change and overshooting our planetary boundaries is a radical reduction in energy consumption. Lower economic growth and a lower population will be unavoidable components of a renewable energy future. That’s not part of the transition narrative, and is a non-starter for most people and political leaders.

Figure 13. Carbon emissions, heating, overshoot of planetary boundaries unlikely to decrease

as long as energy consumption, world GDP and population continue to increase.

Source: OWID, Global Footprint Network , Global Carbon Atlas, NOAA & Labyrinth Consulting Services, Inc.

Click on the image to enlarge.

|

The essence of the metacrisis is that everything is connected. Tinkering with one piece without considering the ripple effects can lead to disaster. Yet, this piecemeal approach is how society tries to solve its problems.

We crave solutions, but do we truly grasp the problems at hand?

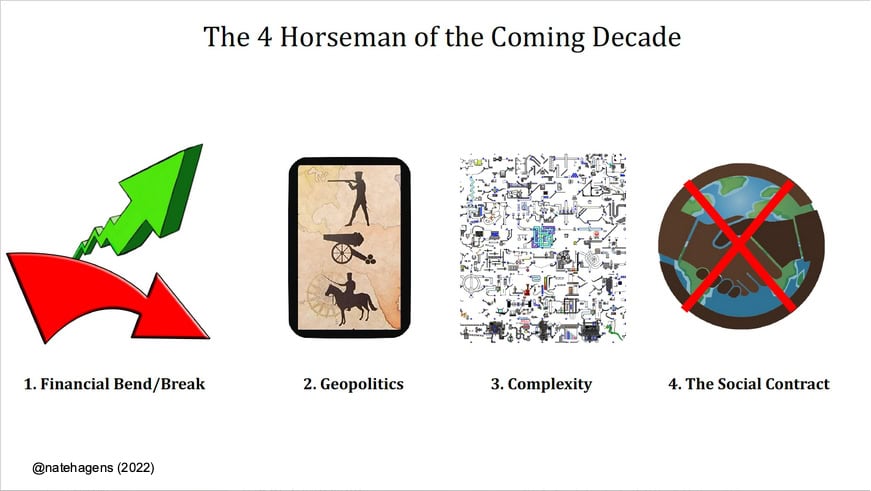

War, financial collapse, failing supply chains, and the collapse of governance threaten civilization (Figure 14). Global heating and the destruction of the natural world are more serious planetary threats.

Figure 14. The Four Horsemen of the coming decade are our greatest risks.

Source: @natehagens (2022). Click on the image to enlarge.

|

Our focus must first be on the whole, not just the fragments. This means acknowledging the natural world as the foundation of our resources and prosperity. Ignoring how our actions affect nature is a core reason for the metacrisis we’re facing. Climate change is just a piece of a much larger puzzle of environmental and ecological breakdown. Focusing solely on carbon emissions misses the broader context—energy, the economy, society, and human behavior.

We need a holistic approach, one that moves fluidly from the whole to the parts and back again. Otherwise, we’re simply shifting problems around, likely making everything worse in the process.

|

ABOUT THE AUTHOR

Art Berman is Director of Labyrinth Consulting Services, Sugar Land, Texas, and a world-renowned energy consultant with expertise based on over 40 years of experience working as a petroleum geologist. Visit his website, Shattering Energy Myths: One Fact at a Time, and learn more about Art here.

|